The likelihood of you seeing this meme during the pandemic is high: “Who led the digital transformation of your company? A chief executive officer, a chief technology officer or COVID-19?”

While this may have been a light-hearted take on what is the biggest crisis we have faced in recent history, there is some amount of truth in it.

Did you know that:

- 94 percent of SMBs in Asia Pacific have become more reliant on technology to ensure business continuity during COVID-19, and

- Nearly 70 percent say they are accelerating the digitalization of their businesses because of the pandemic

While SMBs have been hit the hardest in the current crisis, findings from our newly launched study show that they continue to be a force to be reckoned with, characterized by a fierce spirit of innovation and determination.

Today, as Cisco launches its 2020 Asia Pacific SMB Digital Maturity Study, I’ve been given a renewed understanding of the power of digitalization – and it goes far beyond keeping up with the Joneses.

According to our research, 86% of SMBs in Asia Pacific say they believe digitalization will help in developing resilience against crises like COVID-19. Our research also found that the most digitally mature SMBs are, on average, twice as productive and profitable as the least technologically advanced.

Meanwhile, if even half of SMBs across the region become more digitally advanced in their operations (what we’ve dubbed “Digital Challengers”), we could be looking at as much as a whopping USD3.1 trillion increase in Asia Pacific’s GDP growth by 2024, contributing to economic recovery as we slowly emerge from the pandemic. To put that in perspective, that’s about the size of the Indian economy.

Want to know more? Here’s a quick snapshot of the report.

1. How did we rank SMBs?

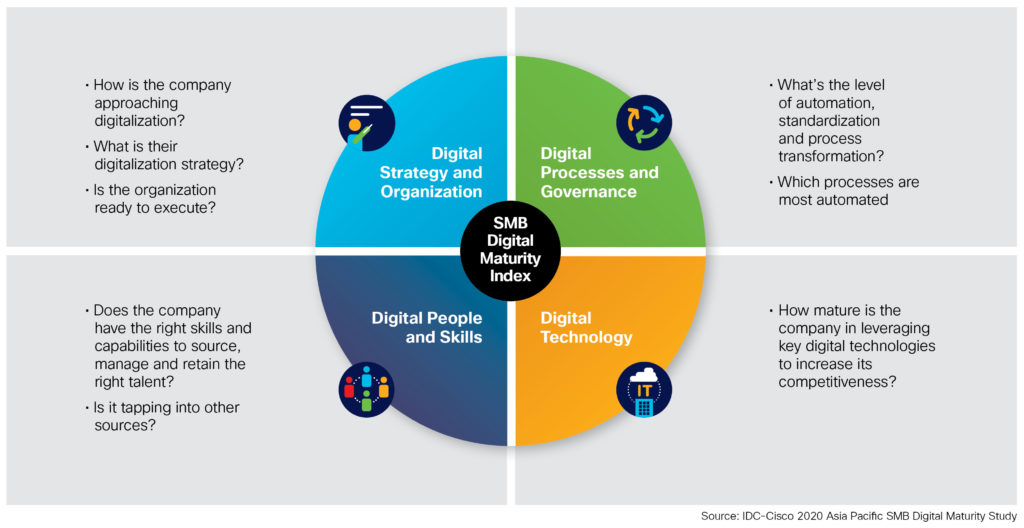

Firstly, a little on our methodology. Working with IDC, we conducted research across 14 Asia Pacific markets, surveying more than 1,400 SMBs from across the region. These respondents were assessed across four ‘digital transformation’ dimensions – Strategy & Organization, Processes & Governance, People & Skills and Technology.

Based on how they scored in these categories, we then ranked SMBs according to four levels of digital maturity – namely:

- Stage 1 – Digital Indifferent: A company that is reactive to market changes and digital efforts do not exist

- Stage 2 – Digital Observer: A company whose digital efforts have started but remain tactile and in bite-sized initiatives

- Stage 3 – Digital Challenger: A company that has a strategy for the use of digital technologies and is more proactive in market responsiveness

- Stage 4 – Digital Native: A company that has an integrated digitalization strategy and is focused on driving continuous innovation

2. Who’s the most mature?

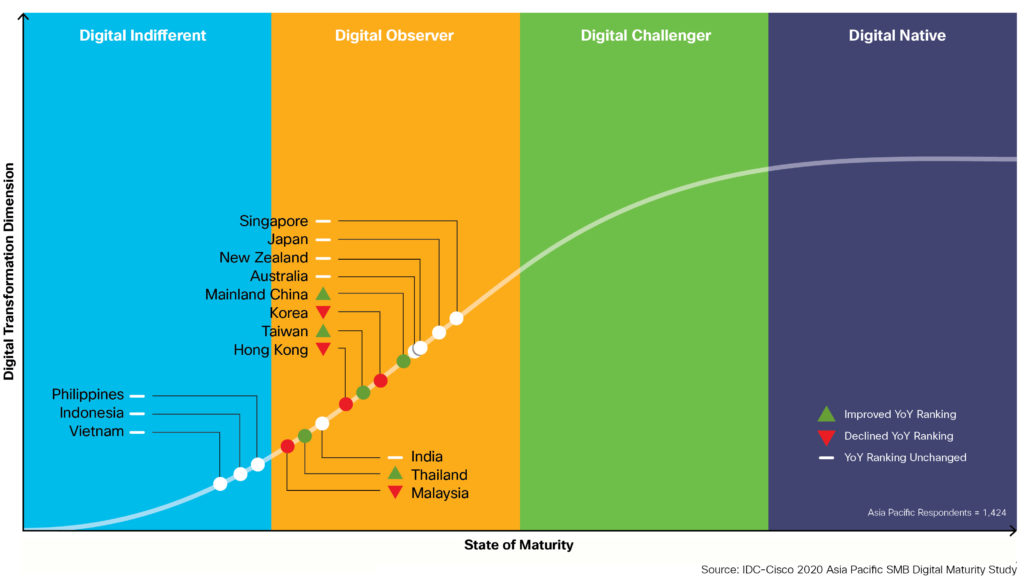

Compared to last year, what’s great to see is that overall, all markets across the region are becoming more digitally mature. Singapore, Japan and New Zealand continue to lead the pack, while China, Taiwan and Thailand all improved their rankings over the past 12 months. However, despite being the least digitally mature, SMBs in Indonesia and Vietnam made the most progress as they edge closer to “Digital Observer” status.

3. Where are SMBs focusing their priorities on?

According to respondents, driving growth and improving customer experiences are top priorities driving digitalization. With COVID-19 and as economies open up, SMBs are focusing on delivering improved customer experience (CX) and launching new products and services to aid recovery. They want to leverage technology to address the need for personalization and deliver new experiences, as part of the new normal.

It’s no surprise that transformation efforts are therefore predominantly starting with front-end and customer engagement. 15% of Asia Pacific SMBs are planning to invest in the cloud in the coming year, while 12% are looking to security solutions – no doubt, in response to increasing regulations around data privacy and with today’s remote work environment. Meanwhile, CX, video conferencing solutions, and AI/Analytics are creeping up the ladder as a result of the pandemic.

That said, purchasing and / or upgrading of IT infrastructures is still in the top five, suggesting that many are still in the process of fortifying their business’ digital capabilities to deal with demand.

4. What’s holding SMBs back?

Regardless of their digital maturity ranking, access to digital skills and the right talent is – by quite a considerable margin – SMBs’ top impediment to further progress.

Beyond people, however, it was interesting that SMBs in the digital follower categories saw a lack of appropriate technologies as a challenge – perhaps suggesting that they are overwhelmed by choice or confused as to where to begin. Lack of budget, customer insights and digital mindset/cultural challenges were also cited.

5. Where to get help?

Considering your own path forward to digitalization to develop business resiliency? Fellow SMB compatriots suggested that the best sources of information came in the form of recommendations from industry advisors and analysts, or simply attending technology vendor events and speaking to potential partners.

If you think that Cisco could be that partner, why not get in touch with our dedicated SMB team today to discuss your concerns.

Or watch this space for updates – here’s a another blog I published recently on how tapping on tech will carry your business through COVID-19 to success.

good